Hello community,

I just arrived in Portugal yesterday with the intent of moving permanently here. From Sweden. I am still trying to understand this system. Do I need to live here for 3 months first before i can become resident? Is there a separate application for residency in PT beside the application for NIF and NISS? Thanks in advance! Cristina

Same question for me, got my nif and niss and living since 2 months in Porto (Im from Belgium)

So, as a European, obtaining a NIF does not make you a tax resident. To become an official tax resident in Portugal, you’ll need to change your address on your NIF. We have a blog post about this here: How to Update Your Address on Your NIF (we need to improve it, go to the chat if you need help, Rosa or Ruben will certainly help you solve the problem).

When you change your address in Portuguese in your NIF, Portugal considers you a tax resident by default. However, you must make sure that you are not a tax resident in another country. You should check with a tax expert and/or check the rules in your home country.

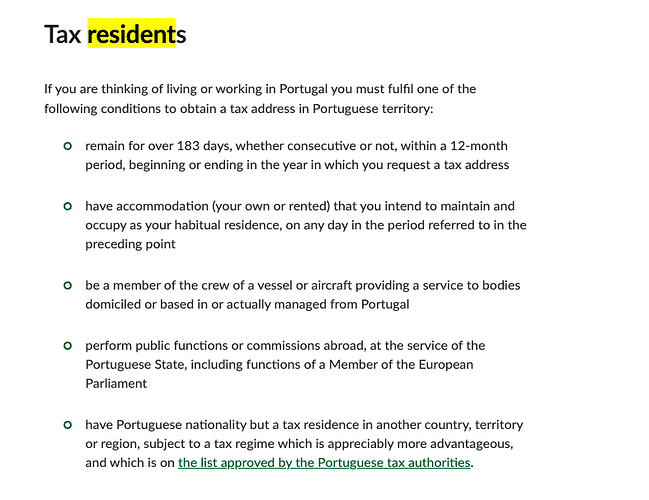

For example in Portugal, hare are the rules that will put you as tax resident in Portugal:

source: Personal income tax (IRS) in Portugal - gov.pt

Re!

We just released an article about getting resident in Portugal as eu : How to become a Portuguese resident as an EU citizen.

The next one for non EU is coming soon !